The traditional financial system and industrial giants are increasingly integrating blockchain technologies. The main goal is to convert real-world assets (RWAs) into digital tokens to reach larger markets and facilitate trade BlackRock and WisdomTree offer tokenized assets as an alternative to the USDT stablecoin.

The financial company Lazard intends to create tokenized funds together with Bitfinex Securities and SkyBridge Invest. In general, anything from gold і lands to stock exchange shares. The number of purchased tokens simply reflects the share of the asset owned by the owner. It is convenient and profitable to sell them, as the transaction takes a few minutes and does not charge huge fees thanks to the use of blockchain technology.

During the recent announcement of the tokenization launch, the director of the Robinhood trading platform saidthat this trend «will open the door to a massive trade revolution».

Content

The main idea of tokenization

It consists of creating digital tokens as substitutes for things like bonds, real estate, or fractional ownership. These tokens can be traded like a regular cryptocurrency 247 anywhere. The massive increase in interest in stablecoins has revived interest in tokenization of other financial assets. A significant impetus was the signing of the US President Donald Trump’s GENIUS Actwhich established the regulatory framework for stablecoins.

Tokenization can completely change the approach to investing, just as streaming services like Netflix once radically changed the way people consume video content. Now, a major player — Robinhood has started offering tokenized trading in shares of large US public companies for its European clients and some distributed tokenized shares of OpenAI and SpaceX.

Crypto exchange Kraken also allows customers outside the US to trade in tokenized stocks, while Coinbase has petitioned regulators to open the market to its US customers. Wall Street giants BlackRock and Franklin Templeton currently offer tokenized money market funds.

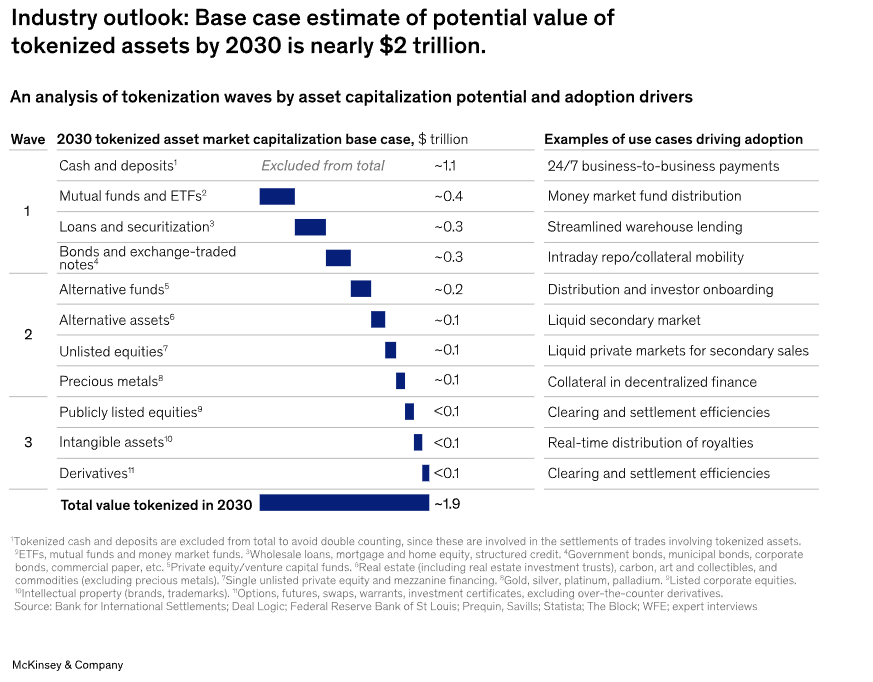

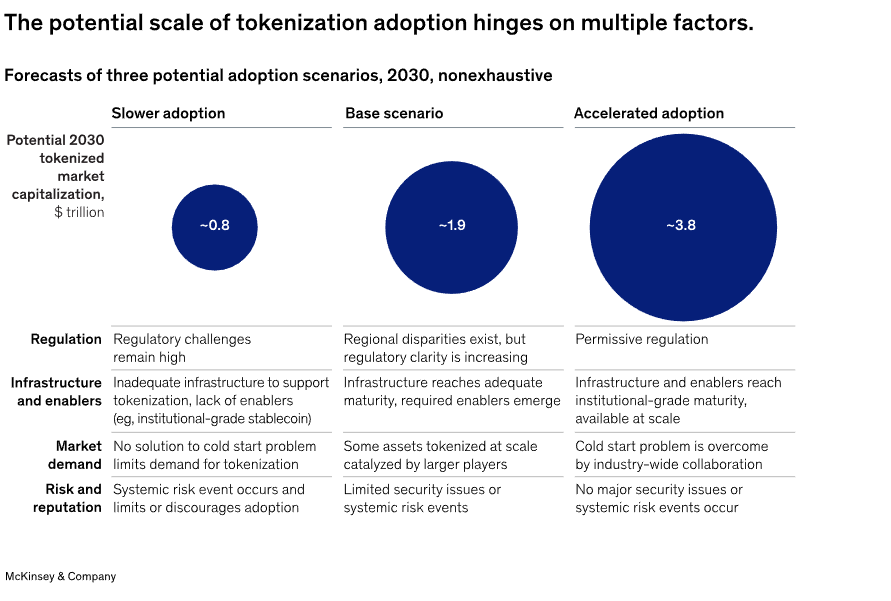

According to McKinsey predictedthat the tokenized asset market could reach $2 trillion by 2030. DTCC, Clearstream Securities Services, and Euroclear appreciated potential of $16 trillion.

Risks remain

Crypto companies were encouraged by Trump’s victory and became more aggressive in promoting their products. Hilary Allen, a professor at the American University of Washington College of Law, believes that the biggest risk is that tokenization is used as a game of regulatory arbitrage and as a way to circumvent the rules.

«We are moving back to where we were in the 1920s. Salesmen going door-to-door were offering stocks and bonds, half of which had no basis in fact, and people were losing their life savings by investing in things they didn’t understand,» Allen said.

However, shortly after Robinhood’s announcement, SEC Commissioner Hester Piers, an open supporter of cryptocurrencies, came out as a cryptocurrency advocate, issued a statement that companies issuing tokenized shares should consider «their disclosure obligations» under federal law. That is, such companies should still adhere to the principles of transparency, publicity and inform investors about risks, financial condition, etc.

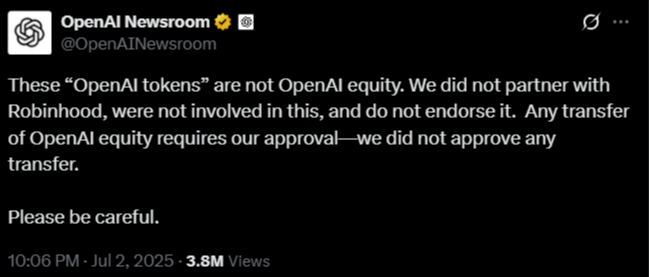

And since tokenization also applies to private companies, their activities are not subject to strict financial reporting requirements. Many startups do not enter the public market, but rather rely on wealthy and institutional investors to raise large sums of money. Critics therefore see this as unfair as it turns into massive wealth generators for a very small group of wealthy individuals and well-connected insiders. Robinhood distribution of OpenAI tokens caused resistance from the company itself, which said it was not aware of the plan and did not support it.

But the process has already started

The tokenization of real-world assets (RWAs) is at the beginning of its development. Nevertheless, a lot has already emerged.

Investment funds

Tokenized money market funds are a new type of investment that allows you to invest and make a profit through the blockchain. These funds have already raised over $1 billion.

Users can choose between trusted companies (BlackRock or Franklin Templeton) or new Web3 startups. Tokenized funds are convenient because they operate around the clock, do not require the participation of intermediaries, and allow for instant settlements.

Loans without queues

There are already companies operating in the US that issue loans on the blockchain. For example, Figure Technologies has become one of the largest non-bank lenders in the field of home equity loans. Digital loans are automated, transparent, and fast. In the future, this will allow assessing the borrower’s financial history (since the history of tokens cannot be changed) — and making decisions without unnecessary documents.

Bonds

More and more companies and even governments are issuing tokenized bonds. For example, the Swiss city of Lugano, Siemens, and the World Bank have already taken advantage of this opportunity. This form allows raising funds faster and cheaper. And the splitting of bonds opens up the opportunity for even small investors to invest. In Thailand or the Philippines, for example, the tokenization of bonds has allowed ordinary citizens to invest just a few dollars in government projects.

Repurchase agreements

Tokenization has also affected the large interbank segment. Transactions of the «repo» type (short-term loans between banks secured by securities) have already been partially transferred to the blockchain. Banks such as J.P. Morgan and Goldman Sachs conduct trillions of dollars of such transactions every month. But now it happens instantly, without errors and with full automation.

The first asset classes that have already been tokenized (money market funds, loans, bonds) are steadily gaining momentum and developing separately from the rest. Further growth is expected in the next 2-3 years. At the same time, other asset classes are likely to scale gradually as «pioneers» pave the way and create a reliable infrastructure.

Alternative investment funds are considered to be one of the most promising areas in the field of tokenization. They can not only attract more assets under management but also simplify accounting. Thanks to smart contracts and interaction between digital networks, portfolio management can be automated, investments can be quickly balanced, and large volumes can be managed more efficiently.

In addition, the splitting of assets and the ability to trade them on the secondary market pave the way for raising capital even from small and private investors and wealthy individuals. This is especially true for funds that previously focused only on large players. And a single digital registry with transparent data can significantly reduce back-office operating costs.

Large companies, including Apollo and J.P. Morgan, are already experimenting with what blockchain fund management might look like. However, the investment assets themselves must also be tokenized. In addition, regulatory restrictions may slow down development in some countries or industries.

For other assets, such as public and non-public stocks, real estate, and precious metals, the introduction of tokenization will be slower. The obstacles still include the complexity of compliance, lack of interest, and relatively little practical benefit in the short term.

Spelling error report

The following text will be sent to our editors: