For a long time, Ethereum has been a topic for memes with a touch of sadness. The network closed the first quarter of this year with the worst profitability since 2018. During the first three months of 2025 Ethereum faces a record number of sales. Despite all this, ETH remains a key player in the cryptocurrency world and the second-largest token after bitcoin with a market capitalization of $235.87 billion.

Despite the wave of popularity of other blockchains, such as Solana (due to the speculative hype around memecoins), Ethereum continues to demonstrate stable development. Its strengths are powerful Layer 2 projects, an active developer community, and a reliable reputation.

Should we expect a powerful jump in Tuzemun after the Pectra update, which finally took place on May 7? This is the largest network upgrade since The Merge in 2022 (and the 19th overall). It promises technical improvements, new opportunities for businesses, investors, and users.

Finally. It has come true!

Update the Ethereum blockchain network’s Pectra (short for Prague and Electra) is a two-layer upgrade that simultaneously improves the Execution Layer and Consensus Layer of Ethereum. It consists of 11 major Ethereum Improvement Proposals (EIPs) aimed at improving the efficiency, security, and scalability of the network.

The most important changes:

- EIP-7702. Regular Ethereum accounts (EOAs) will be able to execute smart contract code, which opens the door to «banking» programming. For example, JPMorgan will be able to implement automated transactions with conditional logic, eliminating intermediaries. It will also allow users to pay gas fees with other tokens, not just ETH.

- EIP-7251. The increase in the maximum validator rate from 32 ETH to 2,048 ETH (a 64-fold increase) will significantly reduce transaction costs for institutional stakeholders such as Bitcoin Suisse, which already uses Obol’s distributed validators. The upgrade will also enable automatic reward accumulation for smaller stakeholders. Both new and existing validators will be able to set up their accounts to receive rewards for the entire staking, up to 2,048 ETH per validator.

- EIP-774. Automatic adjustment of the amount of transactional data in blocks will improve the efficiency of Layer 2 solutions. This will reduce costs during peak loads (no more over-the-top gas during high network load).

As a reminder, in 2022, along with The Merge update, the network switched from the Proof-of-Work (PoW) consensus mechanism to Proof-of-Stake (PoS). Unlike PoW, in which validation is performed through complex mathematical calculations, i.e. mining, in PoS, the creator of the next block is selected based on the amount of cryptocurrency he or she owns.

Assets will be exchanged in a single transaction, as well as a package of actions (for example, deposit, loan, and exchange in one block). Recovery without a seed phrase, for example, with biometric authentication, is allowed. It is now possible to set spending limits for decentralized applications (dApps).

In general, the new changes optimize the network and make Ethereum more attractive to corporate clients. PreviouslyEthereum Foundation (EF) restructures leadership and announces planned Pectra update on May 7. This has led to an increase in blockchain activity.

What’s wrong with Pectra?

Pectra was supposed to be implemented in March. But during testing Ethereum encounters technical problems on the Sepolia network. An unknown attacker discovered a serious vulnerability, so the update was postponed for two months.

One of the main features of the Pectra update is account abstraction (EIP-7702). This functionality allows paying gas fees with alternative tokens. However, users are concerned about a possible decrease in the security of smart contracts and wallets. Users will have to double-check several times when signing transactions on the Ethereum network. This applies not only to this blockchain, it is a general recommendation. But every time, owners lose huge amounts of money because they sign without looking and checking the message. It is also worth switching to wallets with advanced security measures.

Charles Hoskinson, the founder of the Cardano blockchain network, who also co-founded Ethereum, believes that despite all the steps Ethereum will not last more than 15 years. In his opinion, the network has the wrong accounting model, the wrong virtual machine, and the wrong consensus model. Hoskinson also criticized second-tier solutions, which, according to him, have become parasites of Ethereum.

Analysts see the positive

Pectra won’t make the ETH price 10x tomorrow, but it will have a positive impact eventually. Over the past 24 hours, the network’s token price has increased by 6.56% — to $1,956. This is not much and is far from the record high of $4,891. However, this is already a noticeable rise after a long stay in the $1,500-$1,800 zone.

Last year, JPMorgan experts notedthat the Pectra update will strengthen Ethereum’s operational efficiency, provide greater institutional adoption, and retail adoption. UX improvements and simplification of smart contracts will attract new projects to the Ethereum ecosystem. EIP-7742 and EIP-7691 will reduce costs and improve rollup performance, which is essential for network scaling.

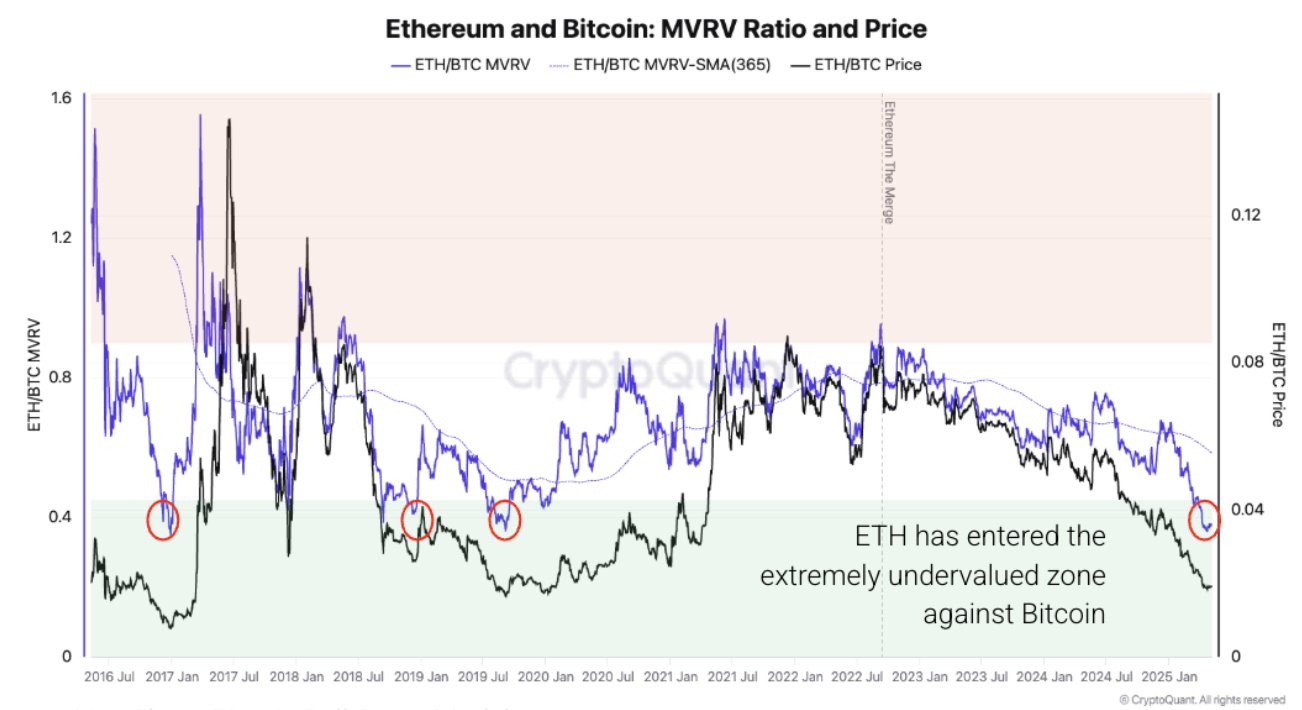

CryptoQuant analysts emphasizethat ETH is extremely undervalued compared to BTC. This is the first time since 2019. Usually, this indicator would lead to Ethereum outperforming bitcoin. However, supply-side pressure, weak demand, and low activity are still preventing a rebound.

The participation of major players also indicates the network’s prospects. BlackRock recently acquired 10,955 ETH for about $20 million. Goldman Sachs increased its investment in Ethereum spot ETFs by 2000% in the fourth quarter of 2024 — to $476 million. Franklin Templeton has applied for an ETF that includes Bitcoin and Ethereum, as well as launched a tokenization project called Benji on Ethereum.

Spelling error report

The following text will be sent to our editors: