In March, the 47th President of the United States Donald Trump signs an executive order to create a strategic crypto reserve for bitcoinand the American Digital Asset Fund. They will not be able to buy tokens to replenish them: they will only be coins confiscated in criminal and civil proceedings. At the end of April, Arizona became the first state in the United States to pass bills to create a bitcoin reserve. The UK followed with a new regulatory framework for bitcoin and crypto assets, which is quite similar to the US one. What is happening around cryptocurrencies globally?

Pioneer Arizona

On April 28, the Arizona House of Representatives passed two bills — 1025 (SB1025) and 1373 (SB1373). They will allow the state to create a reserve of bitcoin and other cryptocurrencies. This will potentially allow Arizona to become the first US state to create its own local cryptocurrency reserve. Senate Bill 1025 (Arizona Strategic Bitcoin Reserve) proposes to amend Arizona statutes to allow the state treasurer and the pension system to invest up to 10% of available funds in BTC. The bill is being actively pushed by Republicans Senator Wendy Rogers and Representative Jeff Weninger.

Senate Bill 1373 (on the Strategic Digital Asset Reserve) would allow the state to own a variety of digital assets, including stablecoins, NFTs, and other blockchain-based assets. The document proposes to create a state-managed reserve fund that includes cryptocurrencies seized by law enforcement and funds appropriated by the legislature, with investments limited to 10% of the total fund per fiscal year.

Both bills are now under consideration by Arizona Governor Kathy Hobbs for final approval. If signed into law, they will come into effect and make Arizona the first US state to create a strategic reserve of bitcoin and other cryptocurrencies. In this case, the state will be able to allocate up to $3.14 billion for this purpose, which is equivalent to about 31,000 BTC. This will make Arizona the second-largest institutional bitcoin holder among public entities in the United States, and will put it ahead of Tesla and Marathon Digital.

However, Governor Hobbs is, first, a Democrat, and second, she has repeatedly vetoed bills from Republicans. If she does sign both bills into law, the state will have to create the appropriate infrastructure to manage the reserves, which could take several months.

Other states, such as New Hampshire, Texas, and Florida, are also considering the creation of digital asset reserves, but Arizona is leading the way.

Critics warn that investing public funds in volatile assets such as cryptocurrencies carries financial risks, although supporters see it as a hedge against inflation and a promising investment.

What is happening in the UK?

On April 29, the UK government published a draft law on the regulation of cryptoassets to protect consumers and increase investor confidence, as currently 12% of the adult population owns digital assets (in 2021, this percentage was 4).

According to the documents, crypto companies offering cryptocurrency services, such as custody and brokerage for crypto assets, must meet strict standards of transparency, consumer protection, and operational resilience — standards that currently apply to traditional financial institutions. This will give regulators the tools to combat unscrupulous players and introduce mandatory standards.

The draft law published by the UK government introduces a series of legal definitions and regulated activities designed to provide clarity, consumer protection, and market integrity. For the first time, crypto service providers will have to obtain authorization from the Financial Conduct Authority (FCA) to operate.

These include: operating a crypto asset trading platform, issuing stablecoins in the UK, holding digital assets on behalf of clients, facilitating cryptocurrency trading or lending as principal or agent, and providing staking services.

Stablecoins, if they are backed by fiat currency or assets, are also included in the scope of regulation.

All of this will apply even to overseas companies if they offer services to retail customers in the UK. Although firms focused on institutional clients may be exempt from these obligations in some cases.

The legislation also includes transitional measures to give existing firms time to apply and, if necessary, wind down their operations in an orderly fashion if permission is not granted.

The draft law does not contain specific provisions aimed at decentralized finance (DeFi) protocols, but the FCA will assess each case on a case-by-case basis.

British Chancellor Rachel Reeves said that the country is cooperating with the United States through the UK-U.S. Financial Regulatory Working Group on Digital Assets.

Meanwhile Switzerland and Australia reject the idea of cryptocurrency reserves. the South Korea did not support this concept. The Czech Republic is still in the process of consideration and analysis. India is considering this possibility. Pakistan highlight excess electricity for bitcoin mining and even has appointed Binance founder Changpeng «CZ» Zhao as a member of the newly created National Cryptocurrency Council.

Who has the most bitcoins?

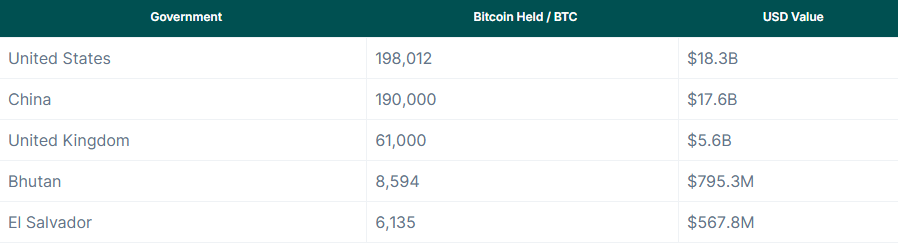

As of April 2025, governments of different countries together hold more than 463,741 BTC, which is approximately 2.3% of the total number of tokens. A year earlier, this figure was 529,591 BTC, reports CoinGecko. Some countries, such as El Salvador and Bhutai, have been actively increasing their reserves, while the US and Germany have liquidated their reserves.

The UK government has the third-largest bitcoin reserve among countries. Ukraine is in sixth place.

- United States of America (USA). The US government remains the largest holder of bitcoin, with approximately 198,012 BTC ($18.3 billion as of April 2025).

- China. Despite a ban on cryptocurrency trading and mining China remains the second-largest state-owned bitcoin holder with 194,000 BTC ($17.6 billion).

- United Kingdom owns 61,000 BTC ($5.6 billion), all of which are related to confiscations. У

- Bhutan has quietly accumulated 8,594 BTC ($795.4 million) through hydroelectric mining.

- El Salvador increased its reserves to 6,135 BTC ($567.8 million). The country continues to buy 1 BTC daily as part of President Nairobi Bukelé’s long-term strategy to integrate bitcoin into the national economy.

- Ukraine. Donations in bitcoin have increased since 2024 to a total of 256 BTC ($21.3 million). These funds were completely liquidated and used for military and humanitarian purposes.

- Germany liquidated all its holdings of 46,359 BTC ($3.9 billion) in mid-2024, causing the price of bitcoin to drop by 15.7%.

Interestingly, this list does not include North Korea, which has accumulated 13,521 BTC after stealing $1.5 billion worth of cryptocurrency from the Bybit exchange.

Spelling error report

The following text will be sent to our editors: