Bitcoin powerfully completes week, reaching $112 thousand before a slight correction. Initially, BTC updated its historical high, after which it rolled back to $111,276. Analysts remain optimistic about the future of the leading cryptocurrency. Overall, BTC has risen by almost 2.4% over the past 24 hours. This has pushed the market capitalization of bitcoin to $2.2 trillion. The coin is among the ten most valuable assets in the world, right behind Amazon ($2 trillion) and Alphabet (Google) with $2.12 trillion.

Bitcoin pulls altcoins along with it

Since the beginning of the week, the price of bitcoin has experienced a significant increase. Several factors have contributed to this positive trend: favorable macroeconomic developments, as well as wider acceptance of BTC by institutional investors.

According to the Fear & Greed index, market sentiment is currently in the greed zone, so altcoins are also growing gradually. The capitalization of the entire crypto market reached $3.43 trillion, which is 0.24% more than yesterday. The capitalization of altcoins is $248.552 billion (excluding Bitcoin and Ethereum).

The new bitcoin record unfolds according to expectations, analysts at 10x Research. After the trend breakout on June 29, similar signals appeared for Ethereum (ETH), Ripple (XRP), and Solana (SOL), indicating a broader shift in the cryptocurrency market.

VanEck expert Matthew Siegel believes that the BTC price of $180 thousand in 2025 is quite realistic. Meanwhile, Bitwise predicts the level of $200 thousand. during the current year. However, the $126,773 mark looks more realistic.

Bullish sentiment continues, but a correction is possible

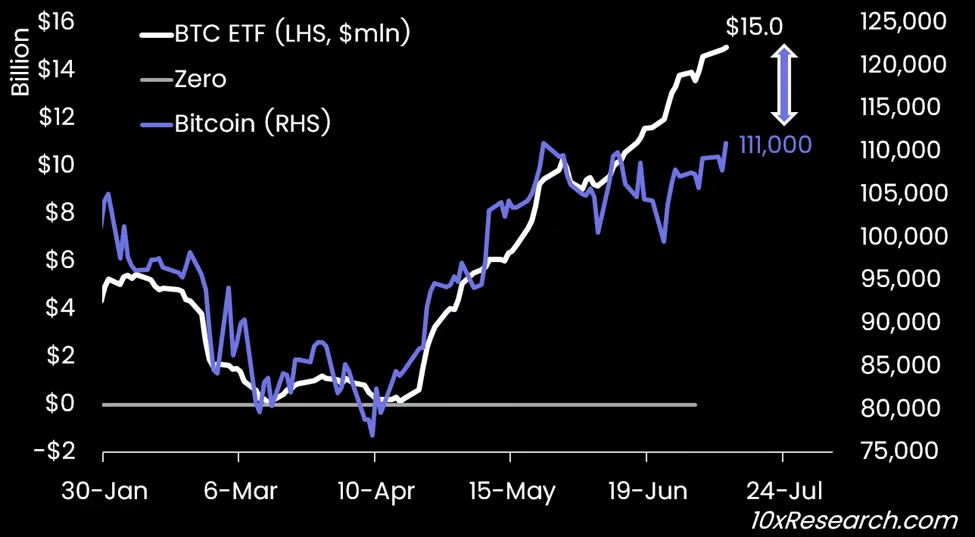

Over the past three months, bitcoin exchange traded funds (ETFs) trading on the spot and listed on a US exchange have attracted billions of dollars in investor capital amid political pressure on the US Federal Reserve to cut rates.

According to Marcus Thielen, founder of 10x Research, the constant flows of capital (large purchases of cryptocurrencies) are now forcing traders who were not prepared for such growth to catch up with the growth through derivatives (futures, options, etc.). This is restoring the bullish momentum.

«The sharp surge in fund inflows into bitcoin ETFs since late April 2025 has been largely driven by political pressure on the Federal Reserve, with Donald Trump openly demanding that Chairman Jerome Powell cut rates to 1% and resign. What started as a partisan push has since broadened — Federal Housing Finance Agency Director Bill Pulte and Senator Cynthia Lummis have also called for Powell to resign,» Thielen said.

Inflows to bitcoin ETFs: $15 billion in net purchases since mid-April. This means that traders who did not buy cryptocurrency at the time or bought too little are forced to return to the market.

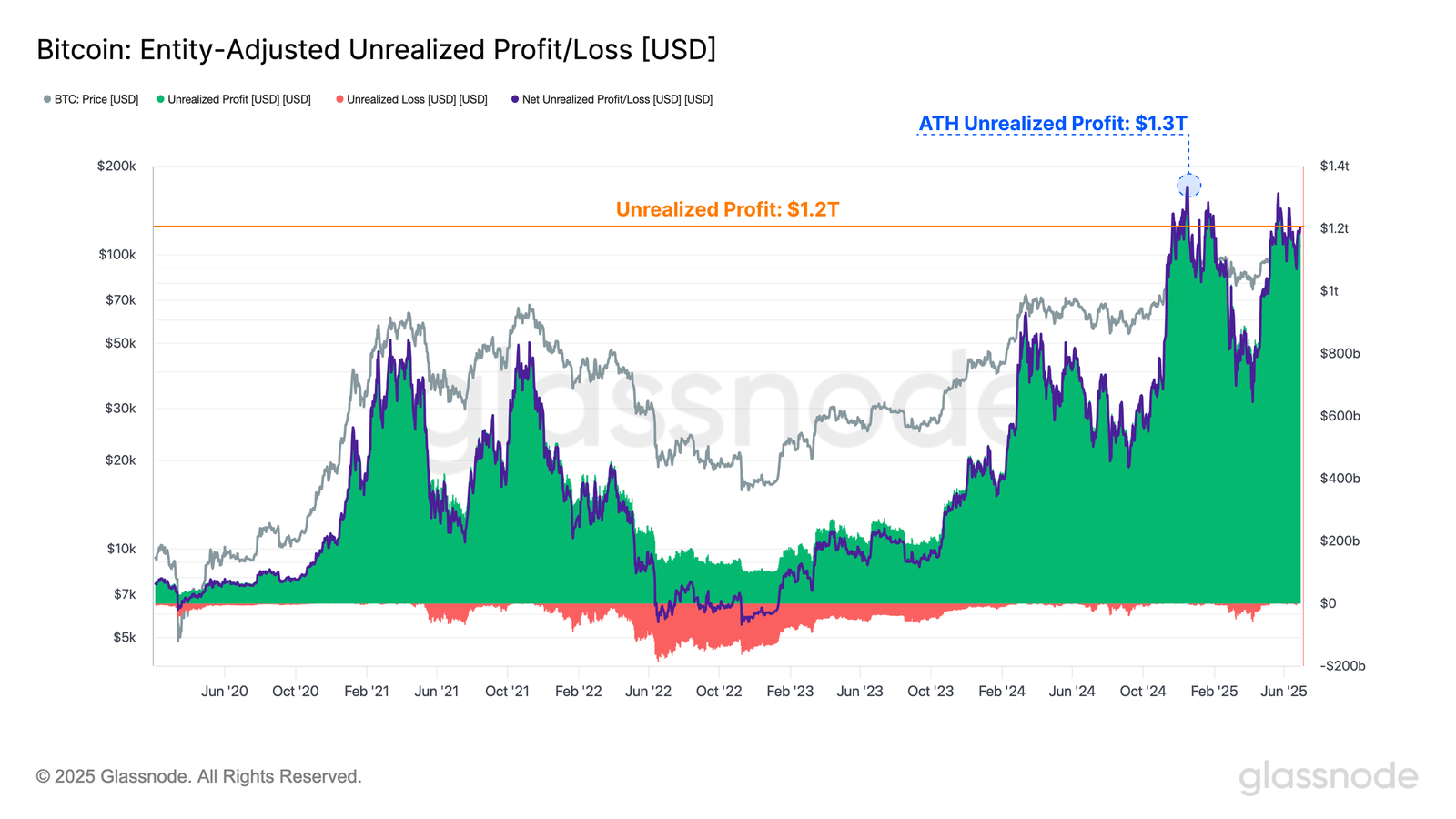

But excessive optimism can be costly. Almost 99% of bitcoin investors are currently «in the black, according to Glassnode. Total unrealized gains amount to $1.3 trillion. This may prompt some of them to take profits, which will lead to a short-term correction.

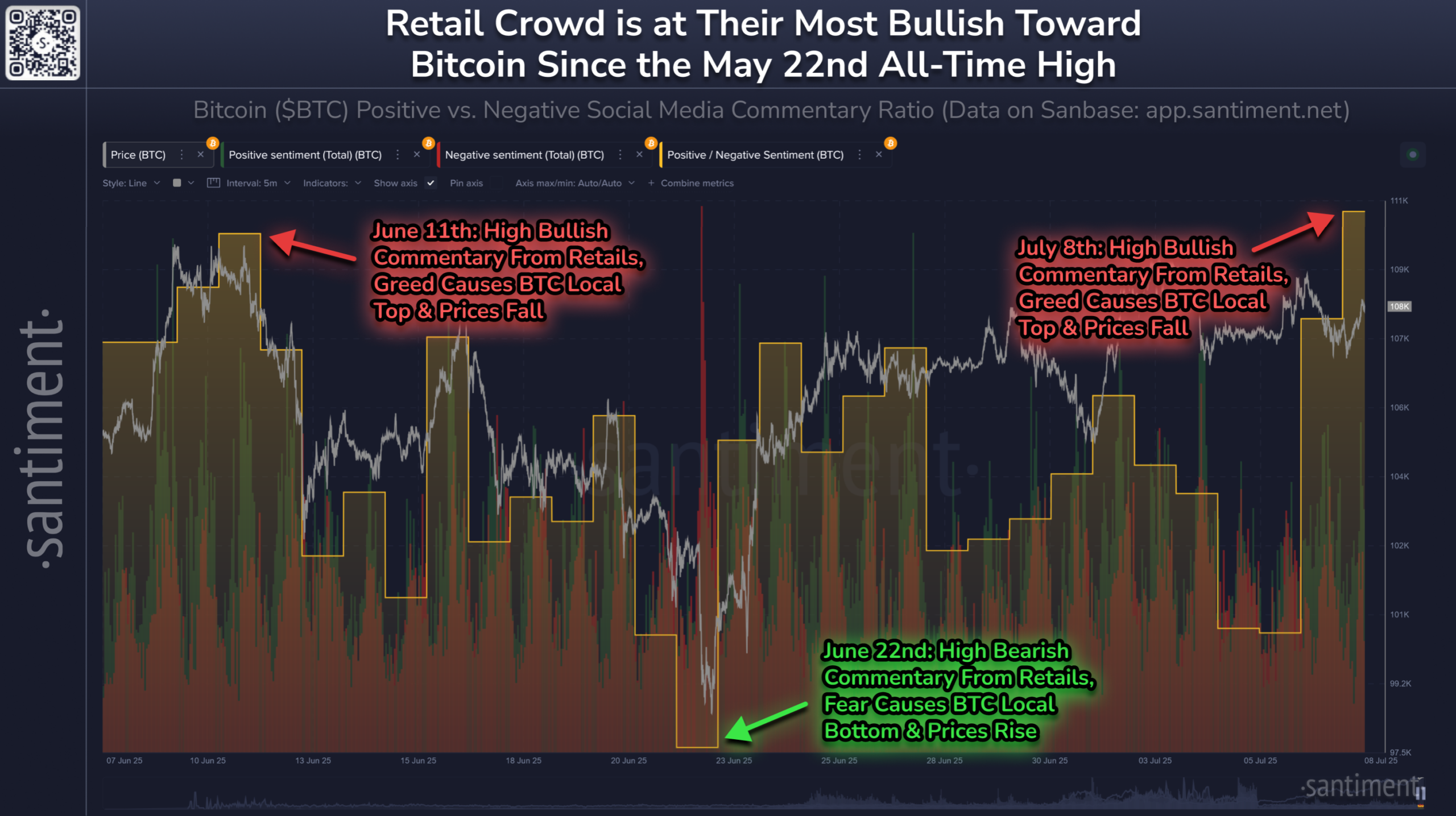

According to Santiment, the ratio of optimistic to pessimistic comments about bitcoin on platforms such as X, Reddit, and Telegram rose to 1.51 — the highest in the last three weeks. However, the previous surges in sentiment on June 11 and July 7 were accompanied by a drop in price. Bitcoin briefly touched $109,595 on Monday before falling to $107,681, likely due to emotional buying and selling by retail investors.

Recently, many retail investors have lost interest or did not believe in growth and have exited the market. This is a classic situation before a breakthrough. History shows that the crypto market often moves against the expectations of the crowd. When small investors show fear or impatience (FUD), it is a signal to experienced players that it is time to buy. And this time, the situation repeated itself.

Now that bitcoin has reached an all-time high after 7 weeks of waiting, if the number of new owners starts to grow, it will be a sign that FOMO (fear of missing out) is kicking in and even more people will start buying BTC.

Spelling error report

The following text will be sent to our editors: