On Monday, July 14, bitcoin breaks the $123 thousand barrier.and Ethereum has risen above $3 thousand for the first time since February. And the total capitalization of cryptocurrencies has reached a new high of more than $3.84 trillion, which is close to the UK’s GDP. What contributed to this growth? Part of it was optimism about regulatory changes. The U.S. House of Representatives planned to discuss three crypto bills between July 14 and 18. The bill on the regulation of stablecoins — GENIUS Act, a draft law on transparency of the digital asset market — CLARITY Act, which establishes clear definitions of what constitutes a security, cryptocurrency or stablecoin, and a draft law on the prohibition of CBDCwhich would essentially prevent the Federal Reserve from launching a digital dollar.

US House of Representatives Republicans announced late last week that Monday would be the start of «Crypto Week».

And it started badly

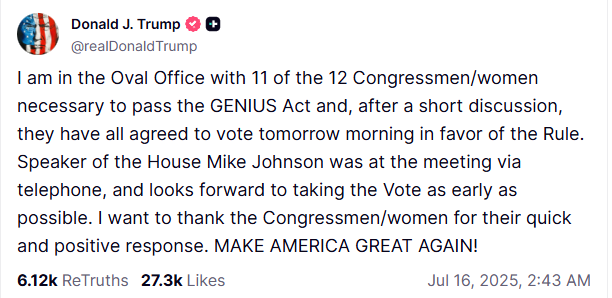

On Tuesday, it failed to get enough votes in the House of Representatives to move to debate. But the very fact that these legislative changes are on the agenda and have moved so far, so fast, raises the question of whether the crypto industry can now officially become mainstream, i.e., an everyday occurrence.

Cryptocurrencies have been in the spotlight in 2025, not least because of the growth of the market’s total capitalization and the changing attitude of the US government towards the issue.

However, neither the rise in token prices nor political sentiment means a transition to the general acceptance of cryptocurrencies. Therefore, holders should keep an eye on such trends:

Increased use of stablecoins.If passed, the GENIUS Act will provide regulatory clarity to the industry, especially with regard to reserves, audits, and Know Your Customer (KYC) rules. This could be a springboard for banks, merchants, fintech companies, and even retailers to issue their own coins. If it becomes cheaper for consumers to make purchases using Amazon or Walmart stablecoinsThis could be a revolution. The changed niche of stablecoins will give consumers in unstable economic conditions easier access to dollars, which will increase the use of digital assets around the world. This, in turn, could be a big boost for blockchain networks such as Ethereum and Solana.

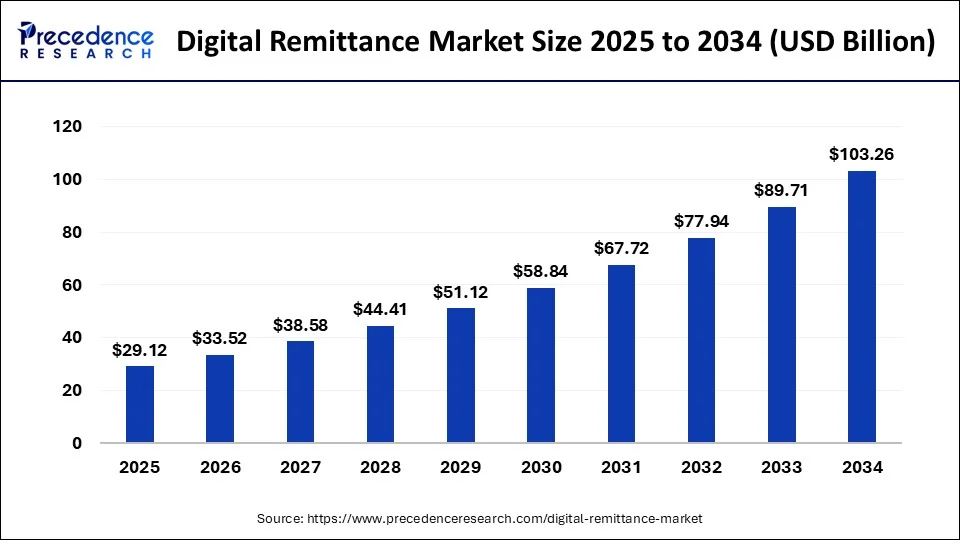

Global acceptance of money transfers. One of the advantages of blockchain technology is that users can make fast, inexpensive cross-border transactions. The company Precedence Research has estimated this market at nearly $29 billion in 2025 and predicts that it could grow to over $103 billion by 2034.

For example, PayPal has already launched its own stablecoin based on the Ethereum network. MoneyGram cooperates with Stellar International payments may well bring cryptocurrencies into the mainstream, especially if a legislative act regulating stablecoins in the United States is adopted.

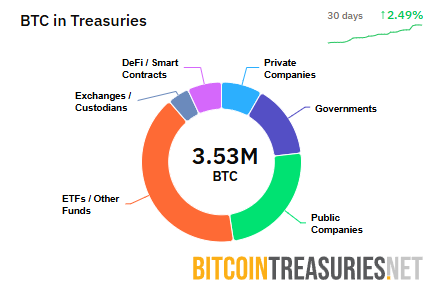

Whether bitcoin will be able to strengthen its position as digital gold. BTC has already shown exceptional resilience in recent months. While tariff uncertainty and geopolitical tensions have rattled stock markets, the leading cryptocurrency has risen by almost 70%. This cryptocurrency is often cited as a hedge against inflation and a store of value, but this has not always been borne out by the price. For example, when US inflation was high in 2021 and 2022, bitcoin was too volatile. This changed in 2025. Partly because spot ETFs made it easier for large companies to invest. According to Bitcoin Treasuries, at the time of writing, there are more than $150 billion in spot bitcoin ETFs under management.

Increased institutional capital usually brings more stability, as well as more money from asset managers, hedge funds, pension funds, etc. What matters now is whether Bitcoin can remain stable, especially if the economy falters. Seven months of good performance does not make it digital gold.

GENIUS Act is getting closer

Last month GENIUS Act passed in the Senate with broad bipartisan supportwhich should potentially create rules for the $250 billion stablecoin market.

Stablecoins peg their value to a less volatile financial asset, most often the US dollar. That is, they are less volatile and risky than other digital tokens, making them a preferred medium of exchange for round-the-clock bank payments and other financial services. Circle is a major issuer of stablecoins and supports the adoption of the GENIUS Act. Stablecoins are stored and exchanged on the blockchain, the public ledger technology underlying other cryptocurrencies.

But one of the biggest risks is that a digital currency can «decouple» from its underlying asset if the value or liquidity of the asset changes. This can cause trading losses or systemic market risks of insolvency and liquidity. For example, in 2023, the failure of US banks Silicon Valley Bank, Signature Bank і Silvergate Bank led to the unlinking of the USDC and DAI stablecoins.

Also, stablecoins are subject to market volatility, technological risks, and depend on supply, demand, and market liquidity.

While the GENIUS Act is awaiting congressional approval, some of the largest US banks are already considering how they can integrate stablecoins into their businesses as they face competition from large fintech players such as Circle. Citigroup, the third-largest US bank by assets, is already developing digital currency capabilities in an attempt to expand revenues and attract customers. JPMorgan Chase, the largest US bank, is also planning to use stablecoins.

On July 16, U.S. President Donald Trump wrote on Truth Social that he had met in the Oval Office with «11 of the 12 congressmen and congresswomen needed to pass the» GENIUS Act. And after a brief discussion, they all agreed to vote «for».

Spelling error report

The following text will be sent to our editors: