Recently NVIDIA becomes the first company to reach $4 trillion in market capitalization. Even US President Donald Trump congratulated manager «green» company with this achievement. But soon, Microsoft may also take this barrier.

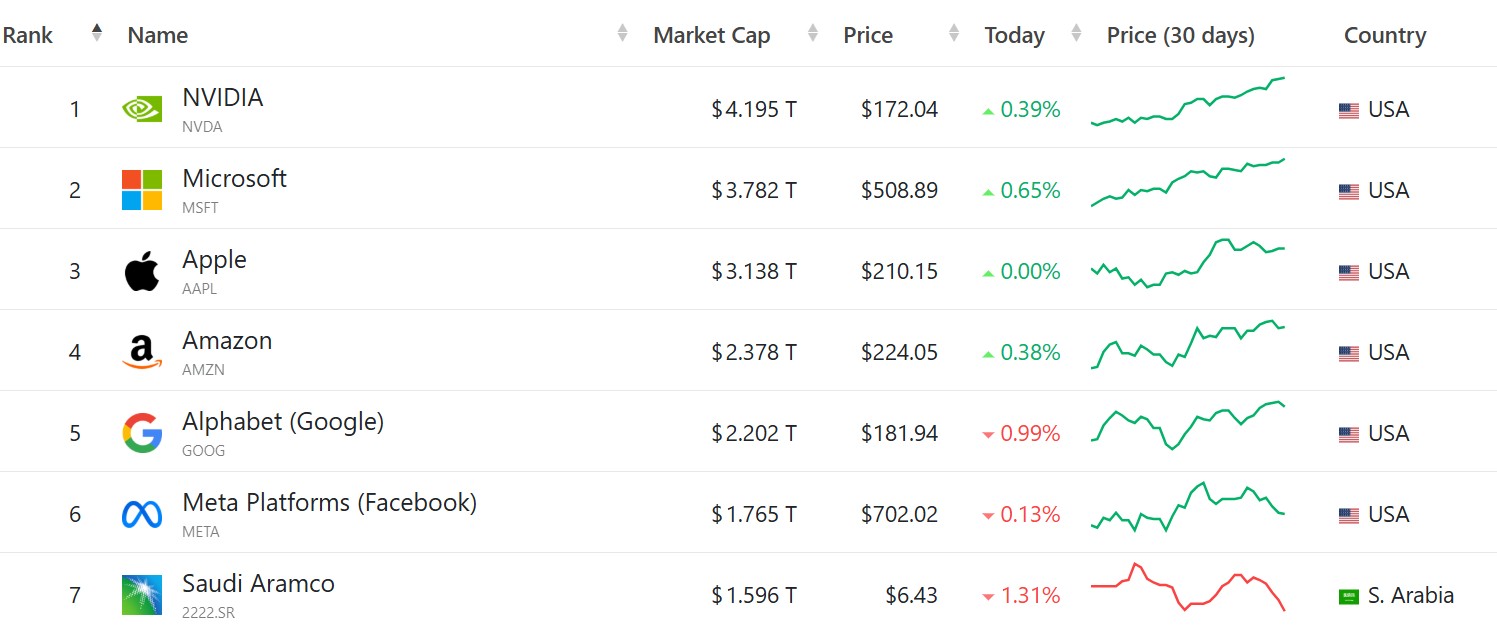

Since the beginning of this year, Microsoft’s share price has risen by more than 19%, significantly outperforming the market. In terms of market capitalization, Microsoft has approached $3.782 trillion, while NVIDIA has already crossed the $4.179 trillion mark. Apple, which until recently was the leader in terms of capitalization, has stopped at $3.1 trillion. At the same time, more and more investors doubt its ability to stay in the game dominated by artificial intelligence.

Microsoft’s growth is largely due to its position in the cloud market. NVIDIA supplies key data center hardware, and Microsoft provides cloud infrastructure through Azure and its partnership with OpenAI. It is this cooperation that supports the work of hundreds of thousands of Azure customers and millions of users of their services. Even Apple, according to media reports, uses Azure and OpenAI models for some of its product functions — and this confirms Satya Nadella’s successful strategy focused on cloud solutions.

In addition to clouds, Microsoft is actively developing a subscription-based business — from Microsoft 365 to Xbox Game Pass. This model provides a stable income that is less dependent on market fluctuations and consumer behavior. As revenues, profits, and dividends grow, so does the company’s share price.

However, there are still some risks. Some analysts consider Microsoft shares to be overvalued, and this may be due to a wave of layoffs in 2024. Increasing profits per employee is one way to keep shareholder value high. But this tactic can have the opposite effect in the long run: employee morale suffers and product quality deteriorates.

For example, Windows, Xbox, Surface, and other consumer products have not been updated much lately or have lost momentum. This creates risks for business diversification. It seems that the company’s management has focused on the strategy of increasing the share price. This is understandable, as executive compensation packages are often tied to shares. However, it is unclear whether this strategy takes into account the actual provision of high quality products.

Microsoft’s second position in the cloud business cannot be considered guaranteed either. Google and other competitors are actively investing in the cloud and their own AI models, while Microsoft relies on its partnership with OpenAI. If new breakthrough AI products emerge, this could change the balance of power. In addition, analysts are increasingly discussing the potential impact of autonomous agent AIs that can completely replace humans — and this is already a threat to Microsoft’s enterprise software.

Despite these challenges, Microsoft demonstrates flexibility and the ability to adapt to new realities. Its B2B business model remains the foundation of its stability, and it is this model that is likely to help the company cross the $4 trillion mark in the coming weeks or months.

Source: windowscentral

Spelling error report

The following text will be sent to our editors: