The US Securities and Exchange Commission (SEC) has changed the vector and made changes to the regulation of crypto funds (ETPs). The new rules are designed to facilitate the creation and management of ETPs that include popular altcoins, including XRP, Solana (SOL), Ethereum (ETH), Cardano (ADA), Hedera (HBAR), Polkadot (DOT) and others.

The SEC’s decision on ETPs, which also includes exchange-traded investment funds (ETFs), will pave the way for the emergence of more flexible cryptocurrency exchange products that will operate without the need to conduct transactions only in US dollars. That is, investors will have access to bitcoin and altcoins through regular exchanges, reducing commissions. This will attract new investors who do not want to understand crypto wallets, keys, and exchanges.

According to Bloomberg analyst Eric Balchunas, the launch of crypto funds in the United States is expected in September-October.

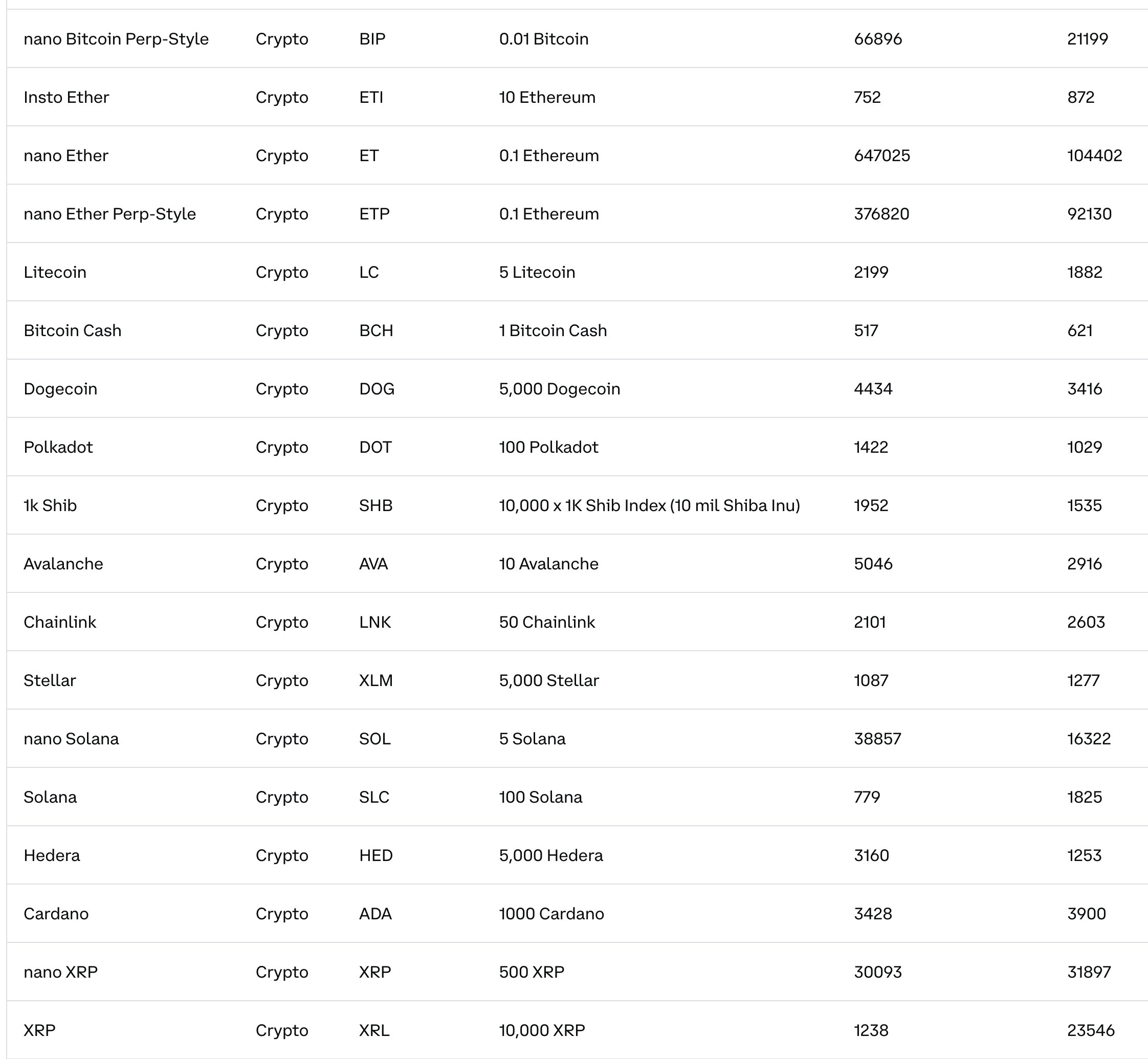

According to the new rules, any asset that has been traded in futures on Coinbase for more than six months can be approved for ETFs. The list includes LTC, BCH, DOGE, DOT, SHIB, AVAX, LINK, XLM, SOL, HBAR, ADA, and XRP.

Interestingly, the SEC announced the changes after the White House Cryptocurrency Task Force released a 160-page report that offered a detailed framework for regulators and lawmakers regarding digital assets.

Source: SEC

Spelling error report

The following text will be sent to our editors: