American technology company Stripe is in talks to acquire crypto startup Bridge for $1.1 billion. If the deal is finalized, it will be the largest acquisition in the history of Stripe and the crypto industry in general.

Market capitalization of the fintech giant increased to $70 billion in September thanks to the recent purchase of Sequoia shares. A new deal could push these figures up significantly. However, negotiations between Stripe and Bridge are still ongoing. The final deal depends on regulatory aspects and employee compensation terms.

Why did Stripe need Bridge?

Bridge helps businesses accept payments in stablecoins. It is essentially a bridge between traditional finance and the world of cryptocurrencies.

The startup’s founders, Sean Yu and Zach Abrams, sold another startup, Evenly, to Block in 2013. Bridge has already raised $58 million in investment and has a strong customer base, including government agencies and companies such as SpaceX and Coinbase.

According to Forbes, if the acquisition goes through, it will help Stripe to dive deeper into the stablecoin market, which has a total capitalization of more than $170 billion.

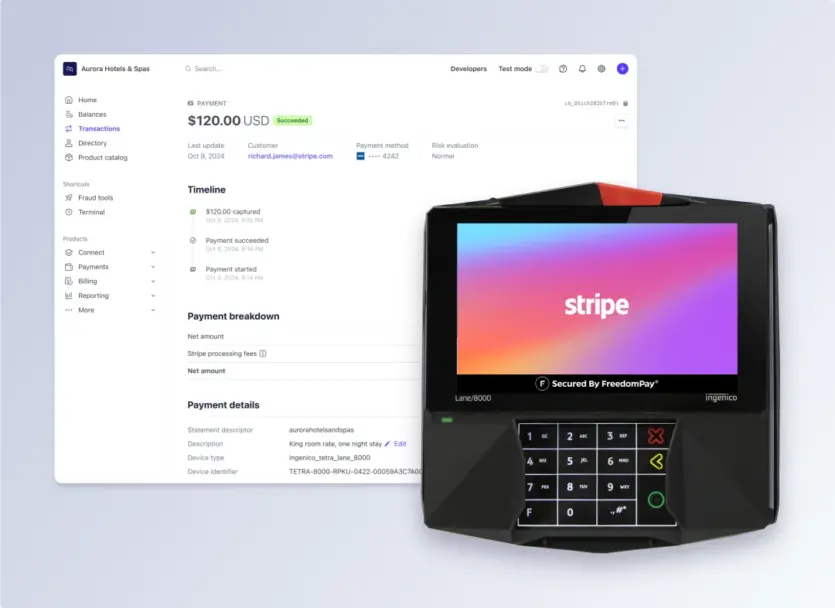

Stripe is actively investing in the cryptocurrency sector and has previously acquired TaxJar and Lemon Squeezy. In October, the company announced a new feature «Cryptocurrency Payment», which integrates stablecoins with the payment system for customers. Stripe president Will Gabriel emphasized that stablecoins can be a more efficient means of payment, especially outside the United States.

Stripe representatives declined to comment on rumors of negotiations with Bridge.

Source: Forbes

Spelling error report

The following text will be sent to our editors: