Despite the joy of traders and longists about the next Bitcoin’s breakthrough beyond $100 thousand. Some analysts do not share this joy. While most influential experts are shouting that BTC should be bought all the time and never sold, Willy Wu sells his assets to invest in bitcoin infrastructure instead.

He explained his decision with an example: when he invested in Exodus Wallet in 2016, the profit from this investment is now 2.5 times higher than the profit from investing in bitcoin at that time.

In addition, in December 2024, Willy Wu invested in Debifi, a non-deposit platform that facilitates bitcoin lending. The analyst sees the platform as a tool that allows long-term holders to borrow more money without selling their assets.

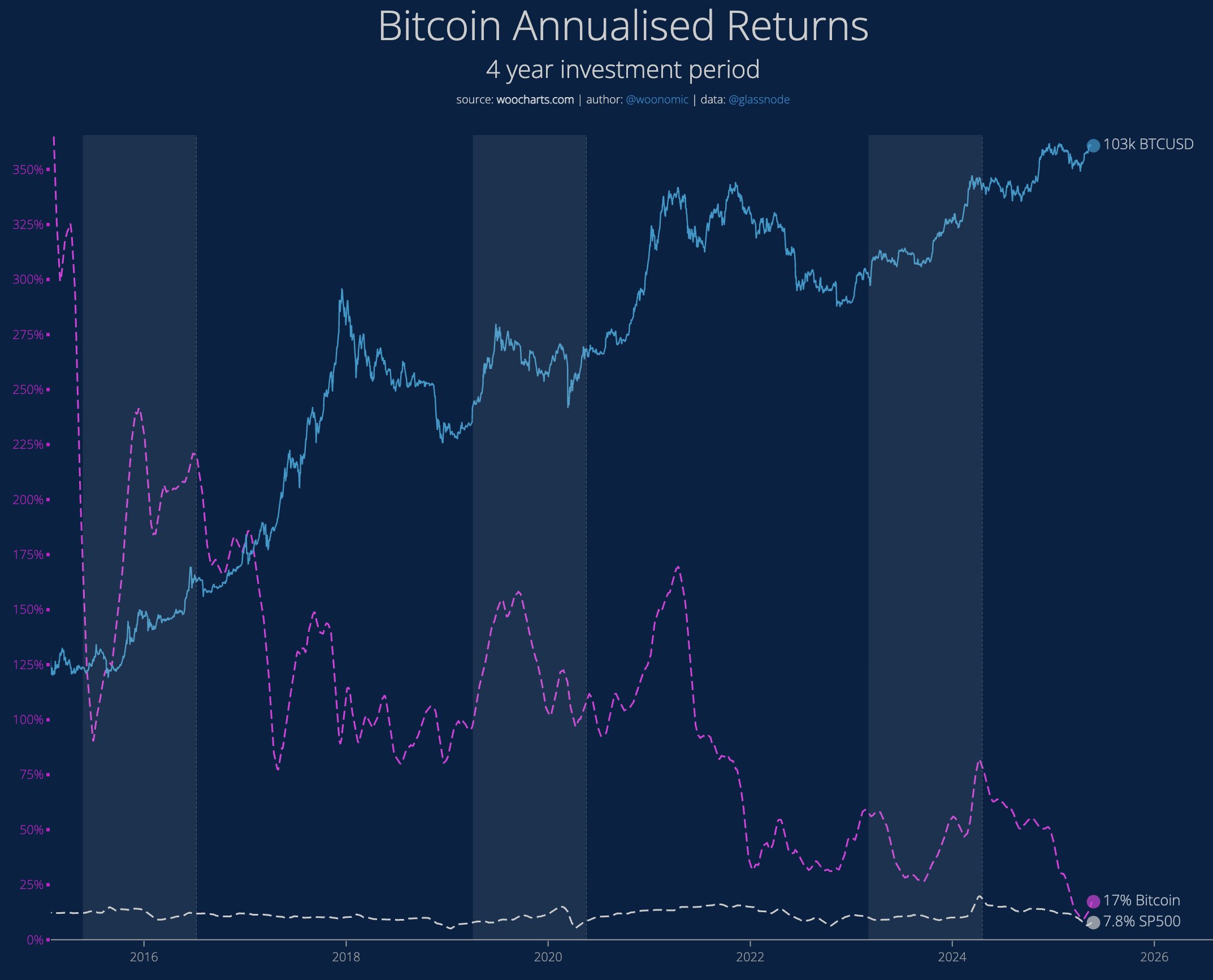

According to Wu, many people think that bitcoin is constantly growing. But in fact, the compound annual growth rate (CAGR) has not been as noticeable as it was in 2017, when gains reached hundreds of percent.

In 2020, large companies and even some states started buying bitcoin. Since then, the growth rate has dropped to 30-40% per year, and this figure continues to fall as the Bitcoin network accumulates more and more capital. BTC is now trading as the newest macro asset in the last 150 years, and it will continue to absorb capital until it reaches its equilibrium.

«Given that long-term monetary expansion is around 5% growth and GDP — 3% growth, I would say 8% is where BTC’s CAGR will stop. Until then, maybe 15-20 years from now, enjoy the ride because almost no publicly traded product can match the performance of BTC in the long run, even if BTC’s CAGR continues to decline»,” Wu noted.

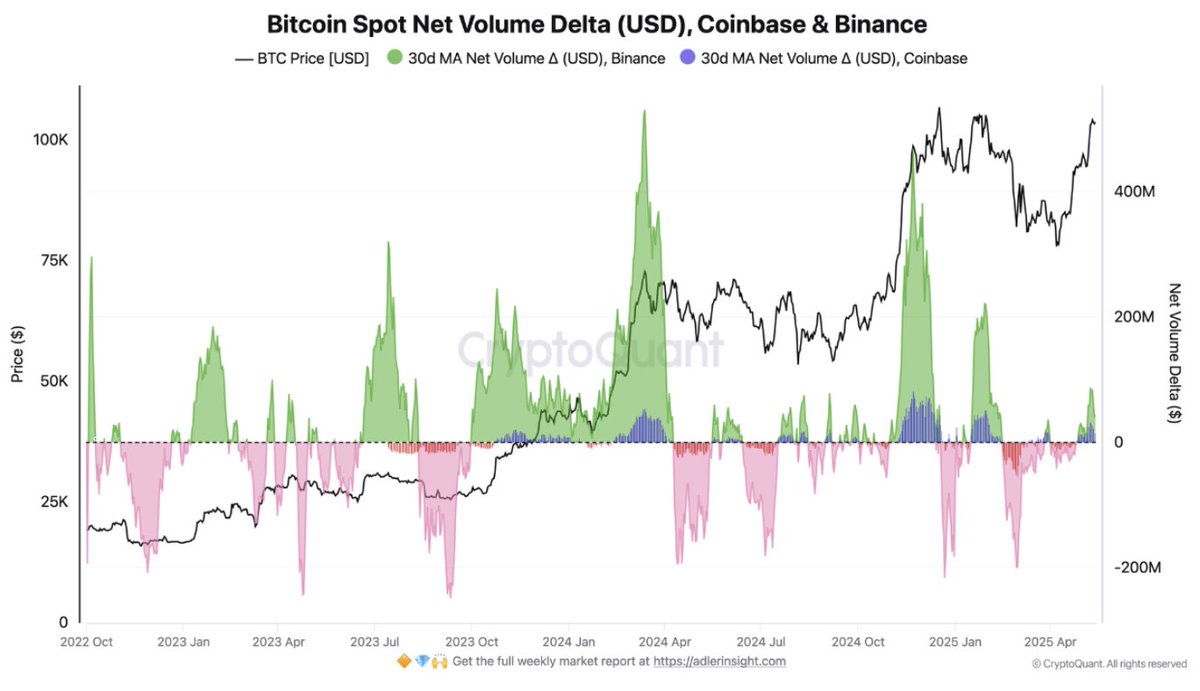

Meanwhile, buying activity on the spot markets is growing. This indicates that the pressure from sellers has significantly decreased. So we can expect growth for the time being.

The day before, the famous venture capitalist and billionaire Tim Draper said that Bitcoin will replace the US dollar within 10 years and will become a standard currency. He also believes that by the end of 2025, BTC will cost $250 thousand.

Spelling error report

The following text will be sent to our editors: