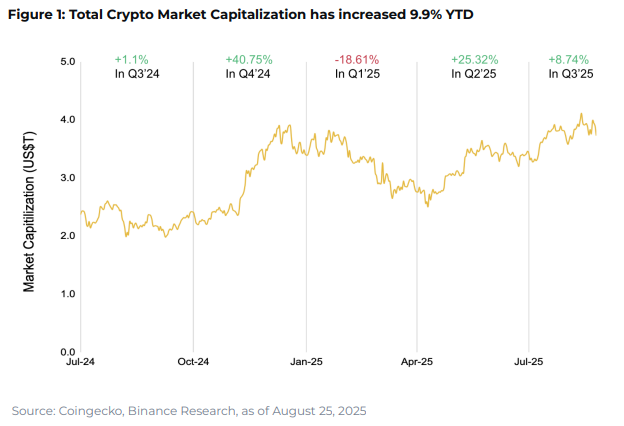

Despite the fluctuations, 2025 was a successful year for cryptocurrencies. The total capitalization has increased by 9.9% since the beginning of the year, adding more than $600 billion in value. After a short-term pullback in the first quarter, the crypto market surged in the second and third quarters, allowing BTC and ETH reaches new all-time highs.

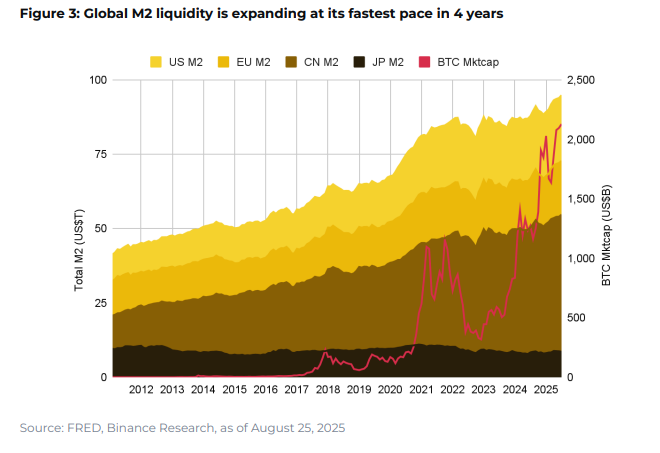

Global liquidity reached a four-year high. This was the strongest six-month increase since 2021.

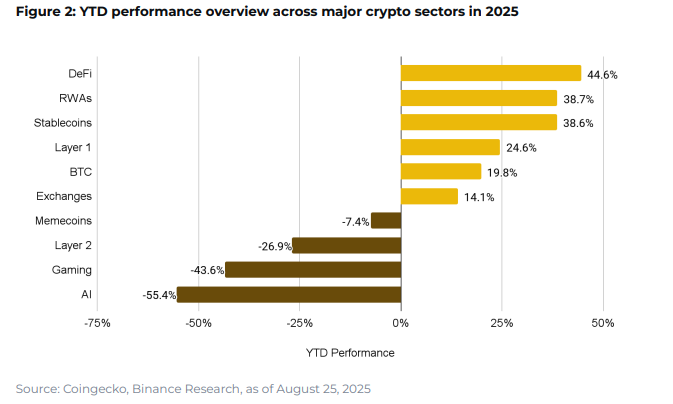

BTC and ETH outperformed traditional benchmarks. ETH grew by about 36%, and BTC grew by about 18%. Bitcoin also demonstrated a unique duality, serving as both a macroeconomic hedge and a short-term risk asset.

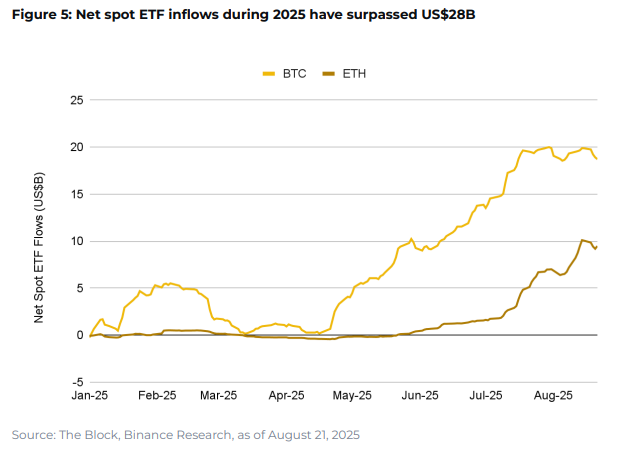

U.S. spot ETFs on BTC and ETH attracted more than $28 billion in net inflows in 2025, becoming the main drivers of volumes in the cryptocurrency markets.

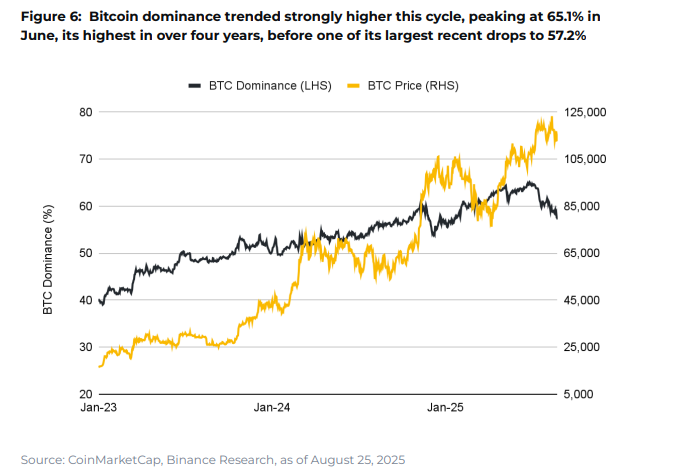

Bitcoin’s dominance has grown from around 40% to 65.1% this year. It has been fueled by demand from ETFs, treasuries, and reserves.

Ethereum staking hits record 35.8 million ETH amid Pectra update and growing institutional acceptance. This is approximately 29.7% of the coin supply.

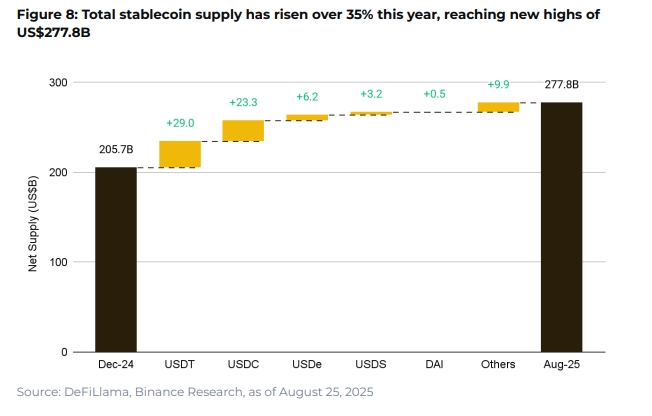

The volume of stablecoins grew by more than 35% to a record high of approximately $277.8 billion. Political clarity has added legitimacy to their actual use and expanded their use in payments and settlements.

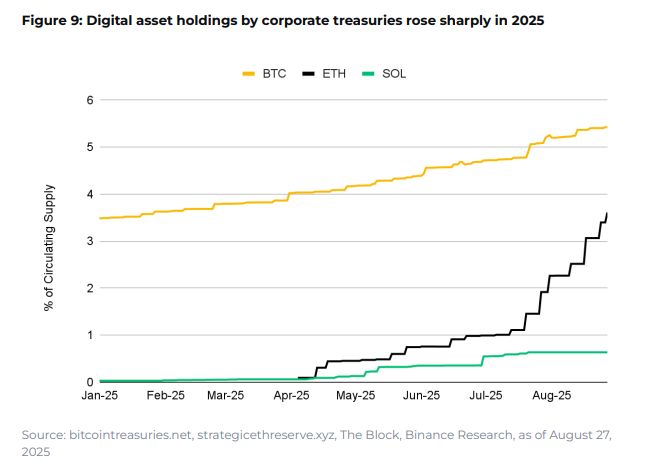

Corporate BTC stocks reached 1.07 million BTC (approximately 5.4% of the coins in circulation) among 174 companies, with Strategy leading the way. ETH wallets also grew by approximately 88.3% last month — to 4.36 million ETH (approximately 3.4% of volume), the largest monthly increase ever.

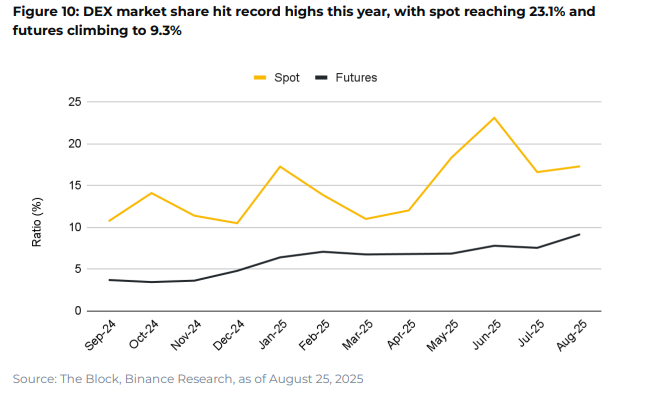

The ratio of decentralized to centralized exchanges (DEX/CEX) reached record highs in 2025, with DEX’s market share peaking at 23.1% in spot trading and 9.3% in futures.

Total blocked value (TVL) in DeFi lending grew by about 65% — to a record $79.8 billion, with loans growing by about 80%.

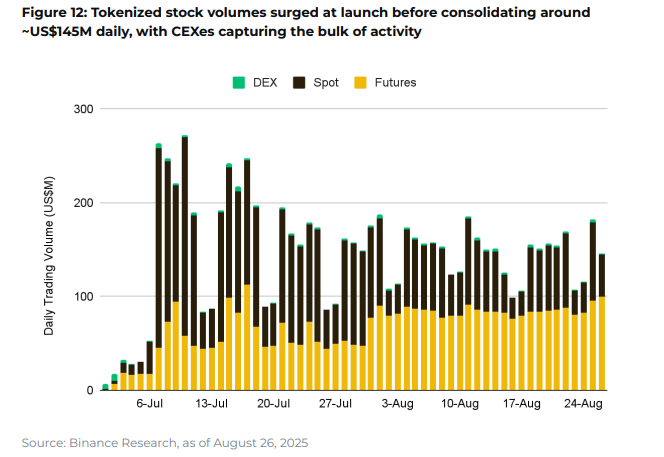

Tokenized shares reached a volume of approximately $349 million in 2025, when cryptocurrency exchanges and traditional brokerage companies began to actively develop this tool.

Source: Binance

Spelling error report

The following text will be sent to our editors: