The cryptocurrency market began to fall this week. American spot ETFs Bitcoin and Ethereum faced an outflow of $1 billion. This coincided with a sharp drop in the price of Bitcoin to $112 thousand.

The massive outflows recorded on Tuesday were the second-largest daily outflows for Bitcoin and Ethereum ETFs in August.

Fidelity and Grayscale suffered the biggest losses. Spot Bitcoin ETFs recorded $523 million in net redemptions. Fidelity’s FBTC suffered the most with outflows of $246.9 million, while Grayscale’s GBTC lost $115.5 million.

Funds managed by Bitwise, Ark Invest and 21Shares, also reported significant outflows. BlackRock’s iShares Bitcoin Trust (IBIT) recorded zero flows for the day.

Ethereum ETFs also suffered, with a total of $422.3 million withdrawn from investors. Fidelity’s FETH fund recorded the largest one-day loss with outflows of $156.3 million, followed by Grayscale’s ETHE, which lost $122 million. Grayscale Mini Ethereum Trust also lost $88.5 million.

The massive outflows from Ethereum ETFs were caused by market turbulence and liquidations as institutional investors reduce their exposure to risk ahead of public reporting of key macroeconomic data. Bitcoin, which touched a record high of $124 thousand. last week, has since fallen by almost 8%, dropping to $112 thousand.

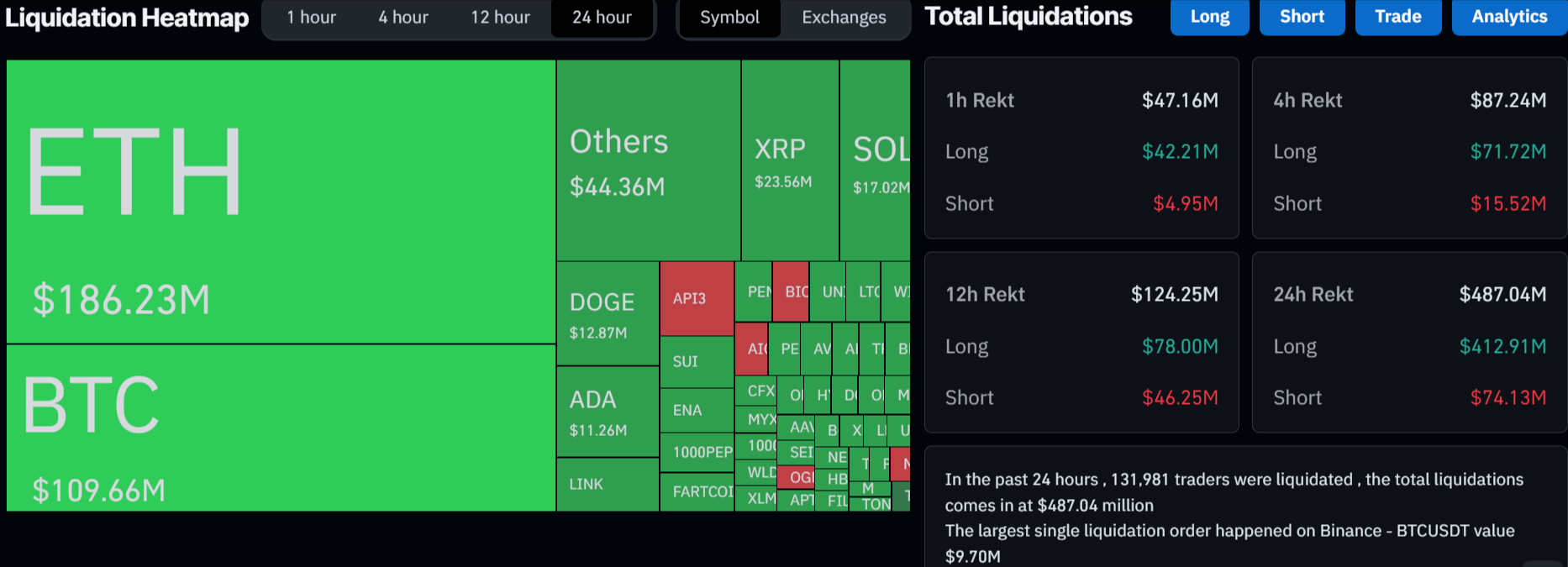

In total, the cryptocurrency market lost 1.5% of its value and is now estimated at $3.9 trillion. The turbulence also spread to the derivatives market, where leveraged positions were massively liquidated.

Coinglass data shows that 131,852 traders have been liquidated over the past 24 hours, totaling $486.46 million. The largest single liquidation order took place on Binance – BTC worth $9.70 million.

Spelling error report

The following text will be sent to our editors: