As of August 13, 2025, ETH is worth $4,675. And there are very high chances that the coin is about to set a new record. The all-time high for the Ethereum network’s native token was $4,878, and it was reached in November 2021. Several analysts believe that current market conditions have created a solid foundation for testing this level through increased institutional purchases and US inflation data.

ETH is actively accumulating

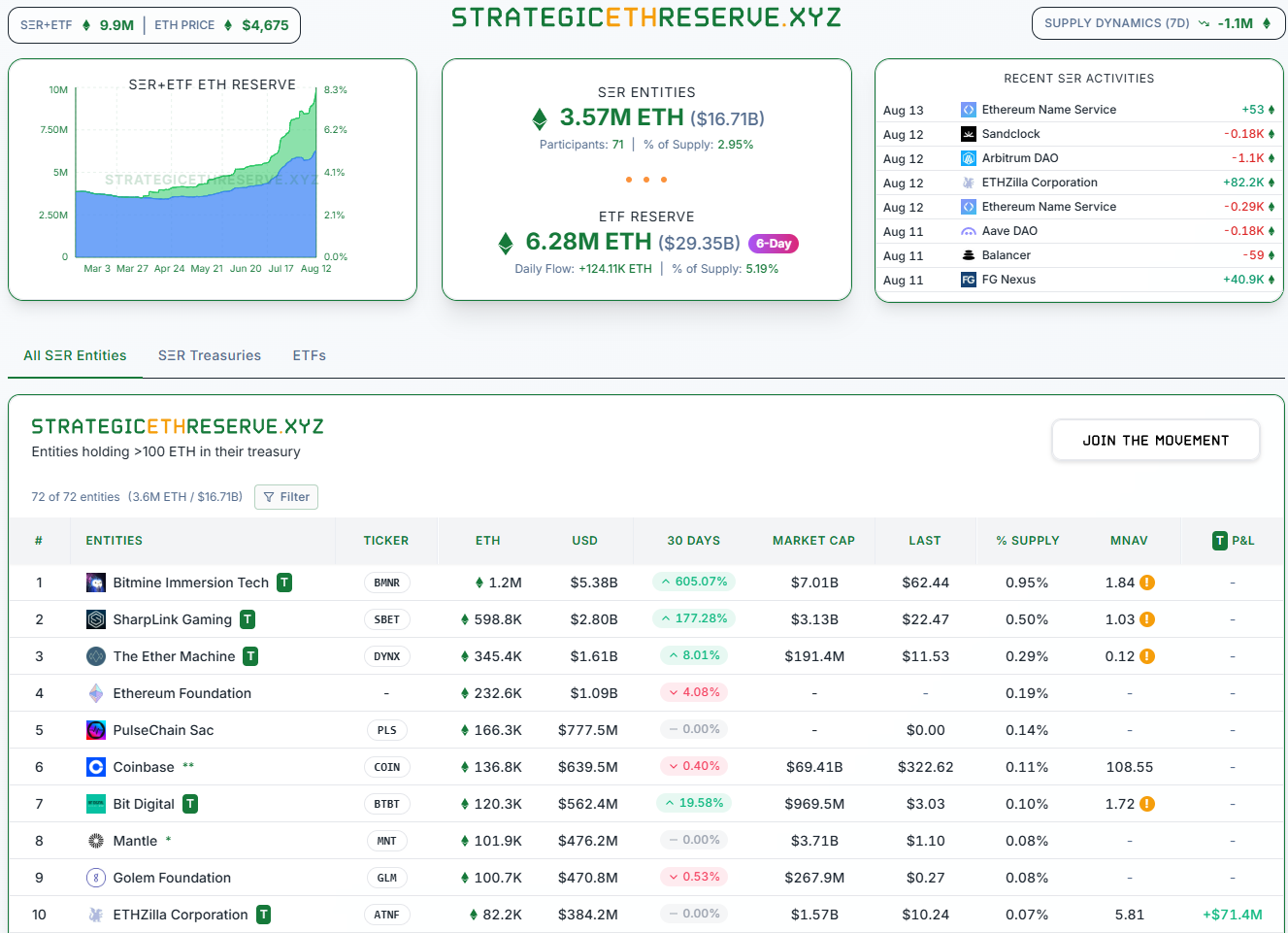

Corporate treasuries have added millions of ETH in recent weeks, with BitMine Immersion Technologies and SharpLink Gaming accounting for more than half of the total ETH held by the top 10 companies. As of August 13, a total of 72 companies have accumulated 3.6M ETH worth about $16.71 billion.

As soon as the spot price of ETH jumped above $4700, the open position of Ethereum futures reached a new all-time high of approximately $35.5 billion.

Institutional activity adds to the bullish sentiment. Pantera Capital, a venture capital fund specializing in cryptocurrencies, invested Pantera has invested $300 million in cryptocurrency treasury bonds, predicting that their returns will be higher than those of cryptocurrency exchange-traded funds (ETFs). Pantera general partner Cosmo Jiang and head of content Eric Lowe said on Tuesday that digital asset bonds (DATs) «can generate income to grow net asset value per share, which will eventually lead to greater ownership of the underlying tokens than just holding on to spot».

On August 12, BlackRock bought ETH for more than $12 billion. And Bitmine Immersion has applied to the SEC for permission to acquire ETH for $20 billion.

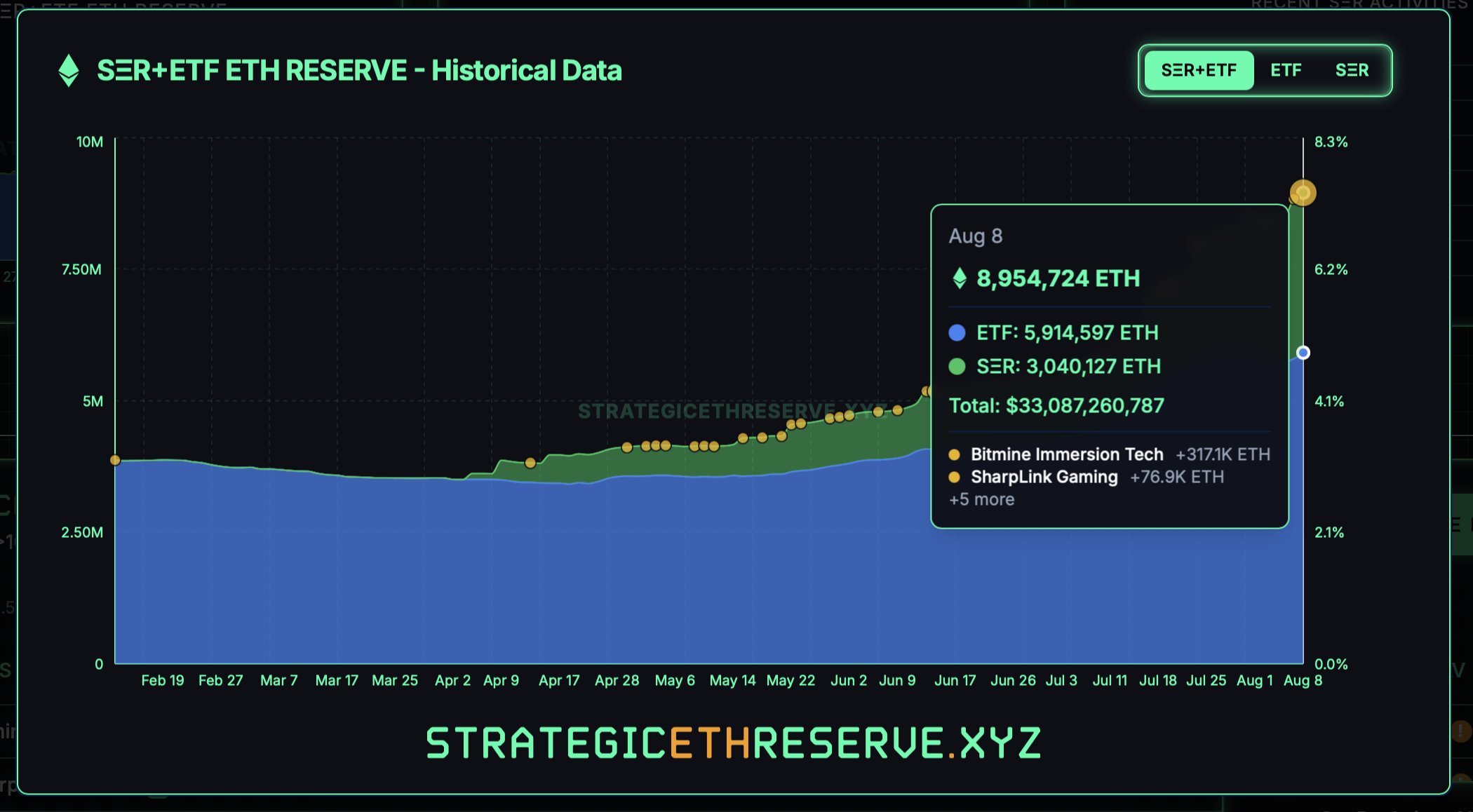

Also, on August 8, about $460 million came into ETH exchange-traded funds (ETFs), compared to $400 million for Bitcoin. This suggests that Ether is currently of more interest to major players than Bitcoin.

Alejandro₿TC expert believessaid that Ethereum’s recent rise above $4 thousand was an important moment, given that the asset has historically had difficulty breaking through this price. If the pace continues, Ethereum will reach $14 thousand this cycle.

Famous investor Michael van de Poppe recalled that ETH grew by more than 100% in less than two months. A new record will definitely be set. But…

A rollback is coming

The same Michael van de Poppe said the market is likely to see a consolidation period after Ether reaches a new price record. In other words, the price may hang in a certain interval.

Also holders of large coin reserves (whales) can start selling their ETH, which can have a significant negative impact on the price. For example, the mysterious organization 7 Siblings sold 19,957 ETH, converting them into 90.44 million USDC at a price of approximately $4532 per ETH.

Bitcoin maximalist Samson Mou notedThe theory is that most ETH holders have a lot of BTC and deliberately exchange their coins for Ethereum to drive up its price in the wake of the Ethereum-wallet trend. But as soon as Ethereum reaches a high enough price, holders will sell off ETH to buy more BTC.

Although the general trend is still the opposite. Prosdata Lookonchain, 182,400 ETH have been withdrawn from centralized exchanges (CEX) in the last 24 hours: Coinbase Pro, Kraken, OKX. But 27,700 ETH were transferred to Bybit. Typically, cryptocurrencies are withdrawn from exchanges for sale and deposited for long-term storage.

Spelling error report

The following text will be sent to our editors: