Ethereum, which was almost given up on after transition to the Proof-of-Stake consensus mechanism and Pectra update, has begun to show who’s boss. Over the past week, the value of the network’s native token has increased by +17.25% and ETH is currently trading at $4,275.67. This brings it closer to the all-time high set in 2021. Back then, Ethereum was worth $4,875.

In addition, on August 8, it broke another record: more than 121 million ETH were in circulation, a new all-time high. For comparison, in August 2022, there were 120 million ETH in circulation, and it took almost three years to add this million.

Currently, approximately 2,500-3,000 ETH are created daily, and this rate remains stable despite network updates. Some ETH is withdrawn from circulation through staking — when users block coins to confirm transactions and earn rewards. This reduces the actual amount of ETH that can be traded and keeps inflation from rising.

As of today, the total number of mined (created) ETH is 157,182,039. Coin inflation will support the price. As will interest from institutional investors and the whales that are now actively accumulate ETH. But they can also bring down the price of Ethereum if they start selling off their stocks. This has already begun in part.

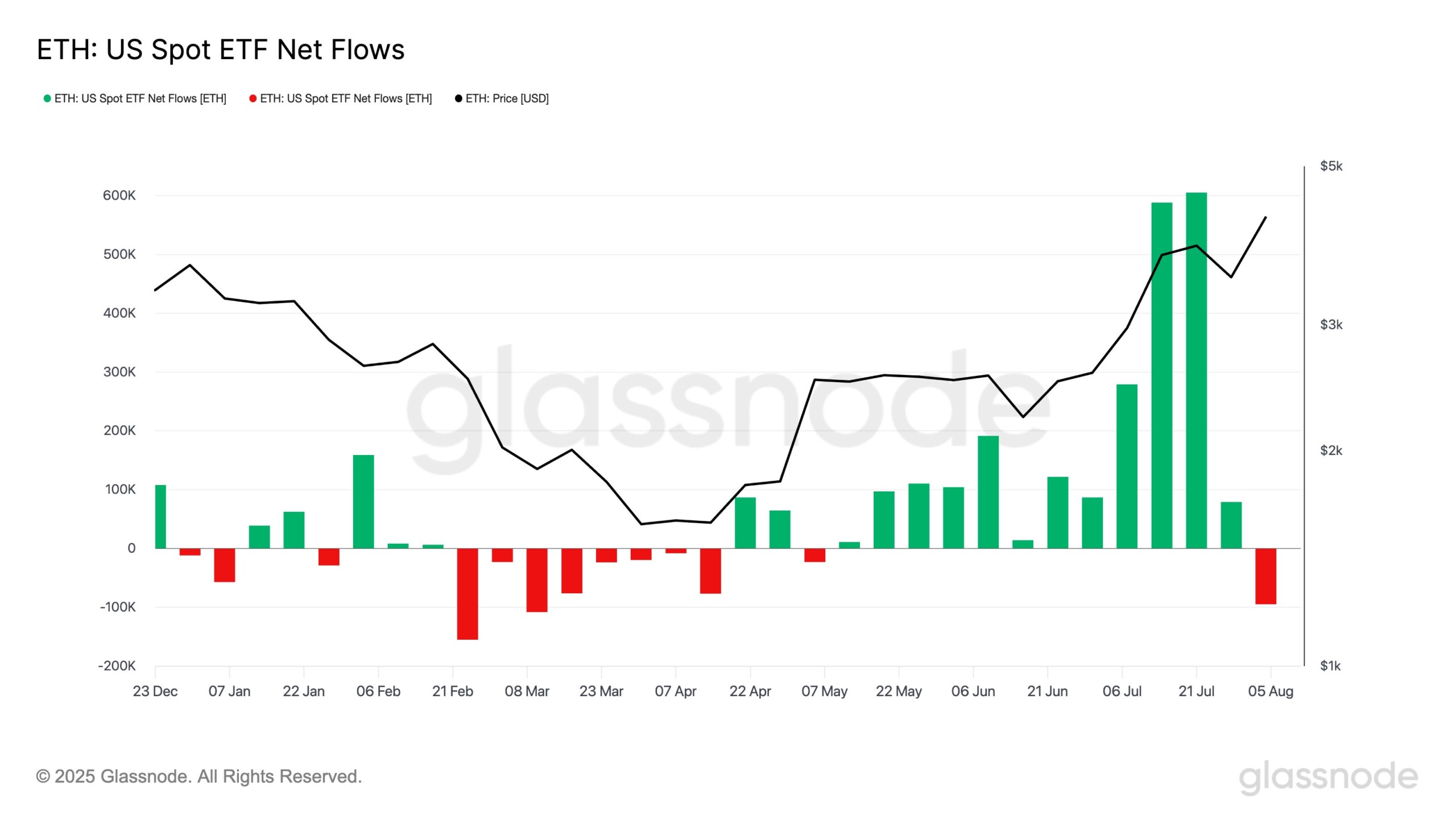

Over the past week, 94 thousand ETH were withdrawn from spot ETH ETFs, the first net outflow in three months. This happened after the price of Ethereum exceeded $4 thousand. Large investors began to take profits after a long period of stable infusions into these funds.

Source: Crypto Quant

Spelling error report

The following text will be sent to our editors: