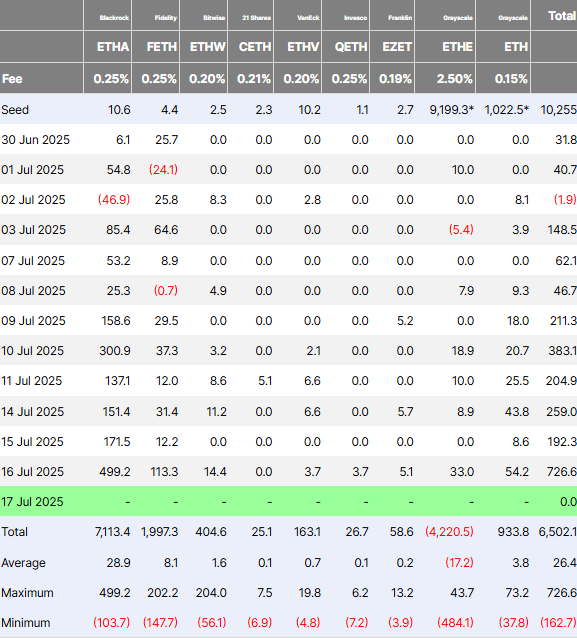

On the afternoon of July 17, the price of Ethereum (ETH) reached its highest level since the beginning of the year at $3,478 Spot ETFs Ether recorded a record one-day capital inflow of almost $727 million on July 16, thanks to BlackRock and Fidelity.

BlackRock’s U.S. spot exchange-traded fund ETHA had a daily record of $499 million and Fidelity’s FETH — $113 million.

US spot Ethereum-ETFs now collectively hold more than 5 million ETH coins, representing more than 4% of the circulating supply

At the time of writing, ETH is trading at $3,436, which shows an increase of 8.27% in the last 24 hours.

Bitcoin’s dominance is likely to have peaked, as evidenced by the continued growth of ETH. In this case, altcoins will go even higher (we are waiting for alt-season). But we need bitcoin’s dominance to drop to 45%. Currently, this figure is 61%.

Corporate treasuries holding ETH now total $5.33 billion.

Meanwhile, BlackRock, the world’s largest asset manager, purchased $416 million worth of bitcoin and $499.2 million worth of ETH on July 16. Currently, BlackRock owns $6.94 billion worth of Ethereum coins and $84.34 billion worth of BTC.

The company also SharpLink Gaming, which became the largest owner of Ether recently bought ETH for $68.4 million.

Spelling error report

The following text will be sent to our editors: